How to Protect You and Your Property From Tornadoes

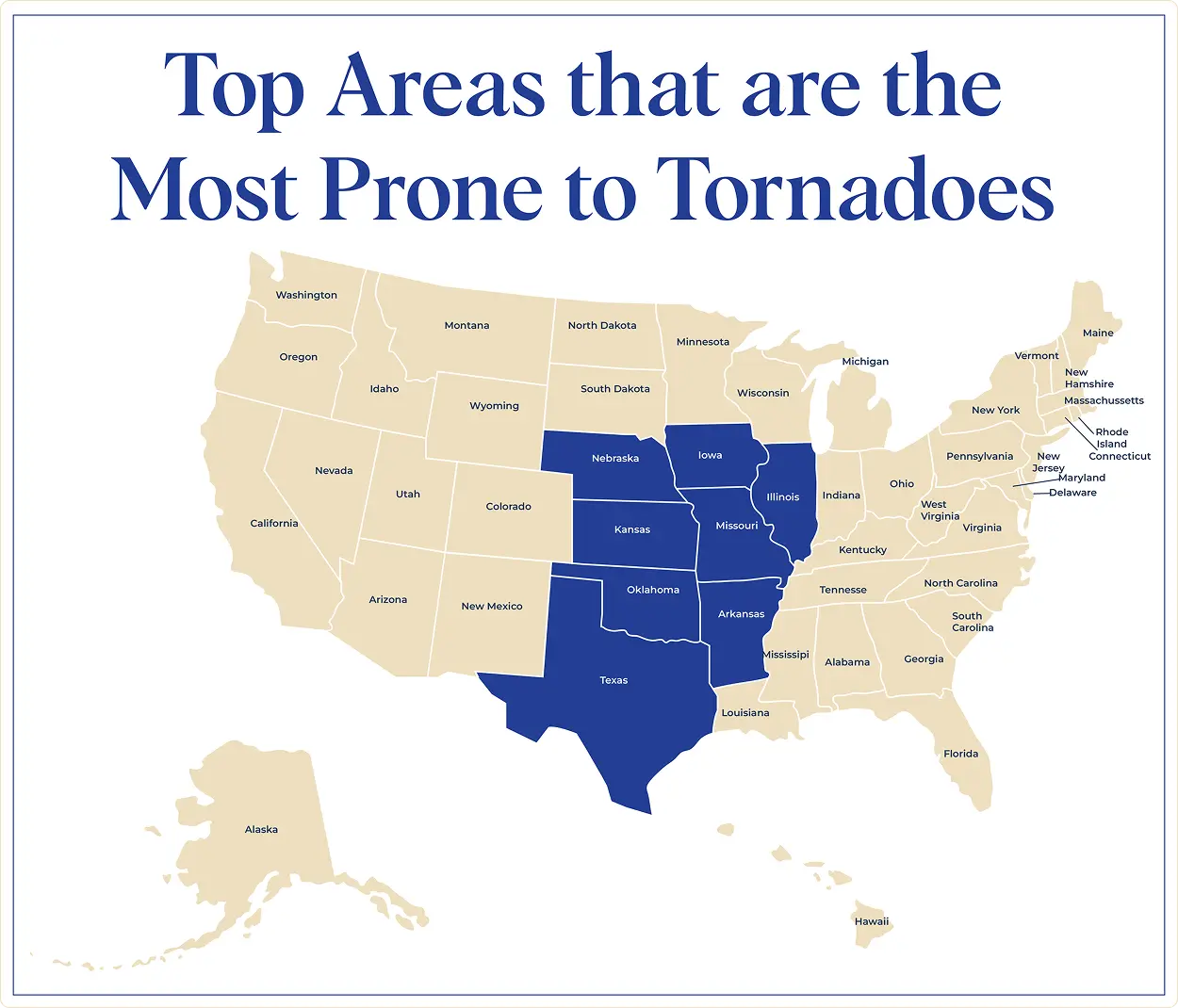

Tornadoes are some of the most powerful weather events, with wind speeds that can reach 300 miles per hour. Contrary to popular belief, twisters can spawn anywhere, at any time of year, but the U.S. Midwest and Great Plains areas are particularly active, especially from spring through fall.

Knowledge is power when it comes to protecting your home and family from tornadoes. Once a funnel cloud is sighted, you may only have minutes to get to safety. Lawrence & Associates Accident and Injury Lawyers, LLC, is proud to provide tornado safety tips to families in Kentucky and Ohio.

Early Warning Signs and Alerts

Twisters form quickly, so you need reliable information fast. If you live in a high tornado risk area, you’re probably already familiar with nearby emergency sirens that go off when a funnel has appeared in the vicinity. If you hear a siren, seek immediate shelter and don’t leave until you hear the all-clear.

Many weather apps will notify you when a severe weather alert is in the area. For the most accurate updates, use one that pulls data from the National Oceanic and Atmospheric Administration (NOAA).

Know the difference between a tornado watch and a warning. A tornado watch means conditions are right for tornadoes to form, while a warning means a funnel cloud has been spotted.

Creating a Tornado Emergency Plan

A tornado safety plan will help you be ready when the worst happens. Sit down with your household and discuss what you’ll do if this weather event occurs.

Pick a spot in the basement or interior of your home to go to in the event of a tornado warning. Decide what supplies to bring to the shelter and assign tasks in advance. For example, one person can secure the family pet while another grabs the emergency kit.

Keep a list of emergency contact numbers on a sheet of paper and in your phone. If you can’t charge your phone, you don’t want to lose access to your contacts.

Download a Free Emergency Safety Plan

Our free emergency safety plan can assist in developing your family’s strategy for tornadoes.

Property Protection Tips

Simple improvements can reduce storm damage and protect your home. Regular maintenance and making upgrades for better storm resistance can improve your home’s tornado safety:

- Install exterior doors with three hinges and deadbolts.

- Secure outdoor furniture and structures to the ground.

- Consider upgrading your windows, roof, and garage door to more tornado-resistant materials.

Though tornadoes can occur year-round, the peak of Ohio’s tornado season is late spring and early summer. It’s a good idea to inspect your property for storm safety each spring.

Essential Emergency Kit Checklist

An emergency kit should contain the vital necessities to survive during and immediately after an emergency. Keep your kit in a safe, easy-to-access place. Consider including:

- First aid kit

- Flashlight

- Weather radio

- Bottled water

- Non-perishable food

- Cash

- Copy of your homeowner’s insurance policy and other legal documents

Putting together an emergency kit is one of the best ways to prepare for a tornado or other emergency.

What To Do During and After a Tornado

If you are at home and a tornado watch is declared:

- Put away outdoor furniture and pick up debris

- Bring children and pets indoors

- Locate your emergency kit

If you are at home when a tornado warning happens:

- Grab your emergency kit

- Move all people and pets into your tornado shelter

- Remain in place until the warning is lifted or you hear the all-clear siren

If you are outside or on the road when you see a tornado, get to a sturdy shelter. If you cannot do that, lie flat on the lowest land you can find, such as a ditch or valley. Cover your head and neck with your arms. Never try to outrun a tornado or seek shelter below an underpass.

Continue to follow weather reports after a tornado. The storm may continue to produce funnel clouds in your area.

Once the danger has passed, you’ll want to assess your property for damage and make your insurance claim. If you have a copy of your insurance policy in your emergency kit, look it over.

Assessing Tornado Damage Safely and Legally

Examine your property only once the threat of storms has passed. Wear long pants, long sleeves, and sturdy, closed-toe shoes. If your home has structural damage or you’re concerned about its safety, stay away and contact local authorities.

Outside, look for damage to your roof, windows, gutters, and yard. Inside, check for water damage. Documentation is vital to filing your water damage claim and any legal action, so take plenty of photos and videos.

Contact local authorities if you see downed power lines or protruding pipes. If you are concerned about the safety of a building, contact code enforcement.

How To File a Homeowners Insurance Claim After a Tornado

You need documentation of your losses to file an insurance claim. Take photos and videos of damage and any temporary repairs you make to your home. Make a list of any ruined or missing property. You can also get quotes from local contractors, but don’t sign anything before you speak with your insurance company.

File your claim as soon as possible. Most policies only give you a year to file for damages.

Dealing with tornado damage can be challenging, especially if you are not getting what you want from your insurer. Still, do your best to work calmly and proactively with the insurance adjuster.

What To Do If Your Tornado Insurance Claim Is Denied

You may have your tornado claim denied with one of the following reasons:

- Not enough coverage: You may have inadequate insurance or a high deductible

- Uncovered damage: The insurance company may say your tornado damage is caused by poor upkeep or an uncovered event

- Insufficient documentation: Your insurance may not have proof of damage and missing property

- Act of God exclusion: Although most insurance companies in Ohio and Kentucky cover tornado damage, some policies may limit it as an act of God

You can file an appeal with your insurer if your hail damage claim is denied. If your claim is missing information or paperwork, it may be an easy fix. If you feel the insurance company is trying to deny a valid claim, you can file a complaint with your state Department of Insurance or contact a property damage attorney.

You may want to talk with a public adjuster, an insurance professional who can assess the damage to your property on your behalf. Their damage report can help you fight a low-ball offer or claim denial.

Understanding Your Legal Rights as a Homeowner

Under the Federal Fair Housing Act, your insurer cannot discriminate against you because of race, religion, sex, national origin, disability, or family status. If you suspect discrimination, you can file a complaint with your state’s Department of Insurance.

You have the right to prompt responses from your insurer. In Ohio, your insurer must acknowledge your tornado damage claim within 15 days and either approve it, deny it, or explain why they need more time within 21 days. In Kentucky, the timelines are 15 days and 30 days, respectively.

Make sure any contractor you talk to is registered with your state’s Department of State, and be wary of anyone who tries to push you into signing paperwork. You have a right to complain to your Secretary of State or the FTC if you feel you’ve been a victim of fraud.

When To Contact a Property Damage Attorney

Though many homeowners may be satisfied with their insurance offer, others experience low-ball offers and denial of valid claims.

If you can’t understand why your storm damage claim was denied, you may want legal assistance. Most property damage lawyers offer a free consultation where you can learn if you have a valid case and what your claim might be worth.

Your area’s bar association may offer low-cost legal services or direct you to an organization that does. If you’ve been affected by a presidentially declared disaster, you may also have access to Disaster Legal Services.

Take Action Now To Protect What Matters Most

Take Action Now To Protect What Matters Most

Tornado safety tips help protect you and your home in the moment, but rebuilding after a disaster can be a long and difficult process. With support from your community and your insurer, you can repair the damage. If your insurance company has denied a valid claim or is giving you the runaround, you can reach out to a public adjuster or property damage lawyer.

The attorneys at Lawrence & Associates have helped hundreds of homeowners in Kentucky and Ohio get rightful compensation from their insurance companies after storm damage. We’re here to answer your questions, so call us at (513) 951-6723 in Ohio, (859) 251-3045 in Kentucky, or contact us online to learn more about filing a tornado damage claim.