Fire damage versus smoke damage—what’s the difference when it comes to your insurance claim? While fire damage is generally pretty obvious, smoke damage is harder to see, and you may not discover it for days or weeks after the fire. Property owners in Ohio and Northern Kentucky frequently find their claims denied or lowballed.

If you’re running into delays, denials, or low offers on a smoke-damage claim, bring in the experts. Lawrence & Associates Accident and Injury Lawyers, LLC, has helped hundreds of homeowners and small business owners push back against big insurance companies and get the money they need to rebuild their lives.

Fire Damage Explained

Fire damage is any deterioration or destruction of an item caused by flames or heat. In a building, it can refer to damaged support columns, charred walls, weakened beams, and even collapsed roofs. Fire can also damage electronics, melt plastic items, and destroy important documents.

Fire damage is generally visible to an insurance inspector as soon as they’re on the scene—it is often the first kind of damage assessed. Inspectors will look for spots where fire has burned through the drywall to damage support beams or a visibly sagging roof.

Fires can also cause significant injury. If you were injured in a fire, look at our personal injury FAQ to learn more.

Smoke Damage Explained

Smoke damage is any deterioration due to debris, odor, or chemical contamination from smoke. Different types of fires produce different types of smoke damage:

- Slower, low-temperature fires produce wet smoke that leaves an oily residue.

- Faster, high-temperature fires produce dry smoke that leaves powdery debris.

- Burnt food or organic material produces protein residue, which can cause persistent odors and discoloration.

Less immediately visible than fire damage, smoke damage can spread much further through HVAC ducts and other ventilation pathways. Clothing may look fine, but carry a strange odor. Electronics may show no visible damage, but may fail to turn on. If not treated promptly, smoke damage can corrode walls and cause health problems.

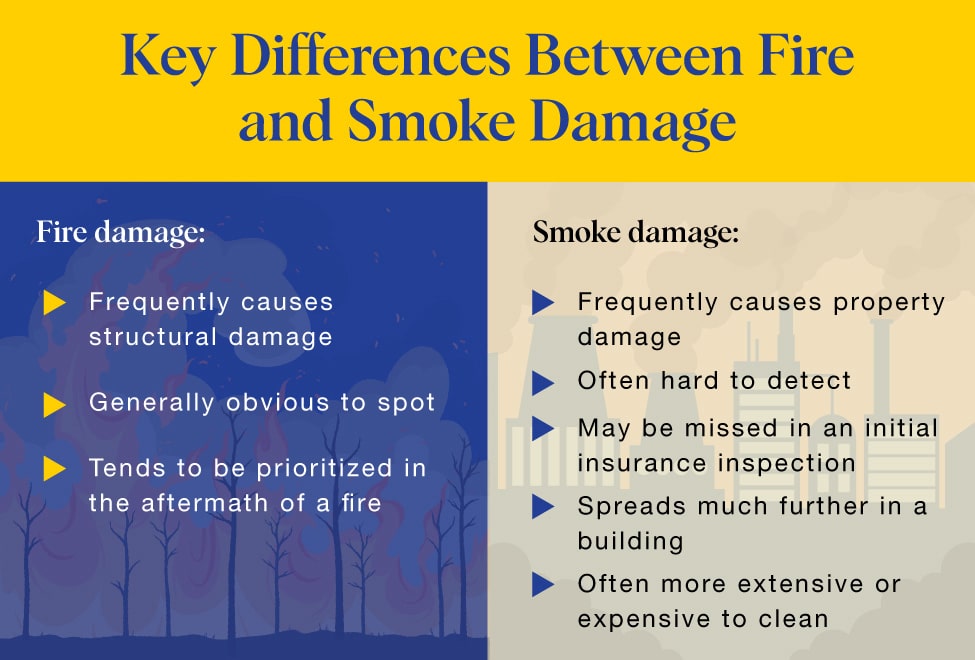

Key Differences Between Fire and Smoke Damage

Here’s how they differ—and why that matters for your claim:

Fire damage:

- Frequently causes structural damage

- Generally obvious to spot

- Tends to be prioritized in the aftermath of a fire

Smoke damage:

- Frequently causes property damage

- Often hard to detect

- May be missed in an initial insurance inspection

- Spreads much further in a building

- Often more extensive or expensive to clean

The main difference between fire and smoke damage comes down to insurance claims. Because it’s more obvious and immediate, fire damage claims are often easier to file than smoke damage claims. Smoke damage claims may require more evidence and are more likely to be disputed by the insurance company.

Knowledge is power. Check out our blog and video library for more in-depth knowledge about property damage claims.

How Each Type of Damage Affects Insurance Claims

Fire damage claims typically lead to repair or rebuild settlements that are paid out quickly. Since fire damage is so obvious, insurance companies are also more likely to pay out large claims.

Smoke damage is often more difficult for adjusters to assess or value, especially when it appears in areas seemingly untouched by fire and may not be obvious until weeks after their inspection.

Simply put, smoke damage insurance claims are more likely to be denied, delayed, or underpaid. If that happens, you may want legal help to fight for what you deserve.

Still have questions? Check out our property damage FAQ to learn more.

Do You Need a Lawyer for a Fire or Smoke Damage Claim?

If you think your insurance company is lowballing you on your property damage claim, there is help available. An insurance lawyer can assist you with handling disputes, getting needed documentation, and negotiating a fair settlement. We can also bring in outside adjusters to accurately assess your damage.

Wherever you are in the insurance process, the team at Lawrence & Associates is here to help you plan your next steps. From the initial investigation to the final settlement, our staff uses their extensive experience to fight for real results. As one of our attorneys, Meagan Tate, says:

“What sets Lawrence and Associates apart from other firms is that we have an experienced staff that has what we call on both sides of the V. So I have worked for insureds, represented insureds, fought for insureds against insurance companies, but I also have an extensive amount of experience working for the insurance companies. So I know how they operate. I know how they evaluate claims. I know what they’re looking for and my staff and I here at Lawrence and Associates can sometimes anticipate issues before they even arise because we have that experience working both for and against the companies.”

If you’re ready to get started, contact us today for a free consultation.

Our Fire Damage Lawyers Can Help You With Your Claim Today

Though both are serious, insurance companies treat fire and smoke damage very differently. At Lawrence & Associates, we understand the challenges you’re facing and are here to protect your rights every step of the way. Our experienced Cincinnati and Northern Kentucky personal injury attorneys can guide you on what to do—and what to avoid—so you don’t unintentionally harm your case.

Call us today at 859-251-3045 in Kentucky or 513-951-6723 in Ohio for a free, confidential consultation, or fill out our online form to get started. Let us fight for the compensation you deserve while you focus on healing.