What Will Happen to My Spouse If I File Bankruptcy?

Posted on Wednesday, January 3rd, 2018 at 9:59 am

There are a lot of reasons to file a bankruptcy, and there are even more reasons to not want your spouse involved. From our Northern Kentucky office, Lawrence & Associates Accident and Injury Lawyers, LLC has filed thousands of bankruptcies and seen hundreds of scenarios where it would benefit the people in debt to have only one spouse file for bankruptcy. While we’ve discussed the effect on a non-filing husband or wife when their spouse needs to file bankruptcy before, there are many angles to this question that appear in multiple blog posts rather than all in the same place. This post will consolidate that information.

How Do You Decide Whether Both Husband and Wife Need to File Bankruptcy Together?

The most important consideration here is determining which debts are driving you toward bankruptcy, and whose name the debts are in. Debts that were obtained in both spouses’ names will make each spouse jointly and severally liable for payment of that debt. For example, if you are behind on your credit card payments and afraid of getting sued, a Chapter 7 bankruptcy is one way to get out from under that high interest rate debt. But who signed the credit card agreement and whose name is the account in? If only the husband or only the wife signed, then only that spouse will need to file bankruptcy. But if both spouses signed the agreement or have cards in their names, then both spouses MUST file bankruptcy to wipe out the debt. If only one spouse files, then the credit card company can still sue the non-filing spouse.

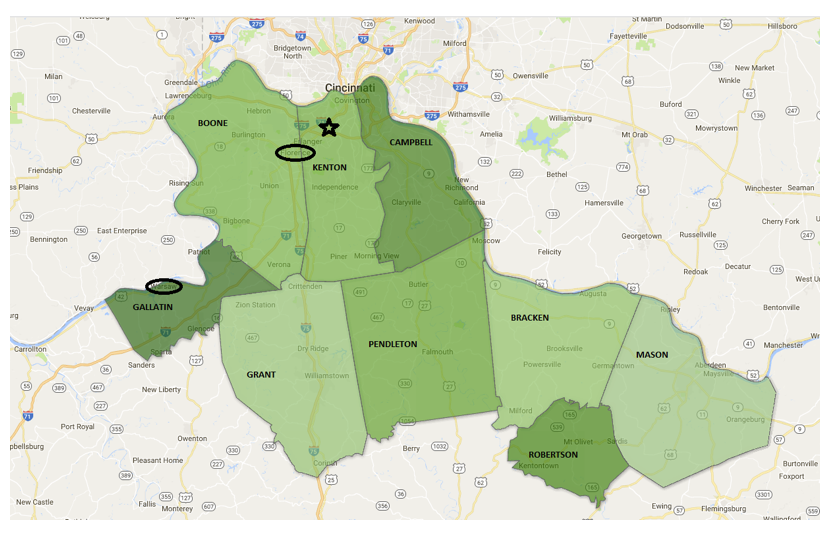

If you don’t know whether you might be liable for your husband or wife’s debt, the answer depends on where you live. We covered Kentucky’s equitable division rules previously in this blog, but only at the state level. At the county level, even in an area as small as Northern Kentucky’s seven counties, there is wide variation depending on the judges involved. Boone and Gallatin Counties have one family law judge; Kenton and Campbell counties each have their own family law judge; Pendleton and Robertson Counties share a family law judge with other counties outside the Northern Kentucky area, and; Grant, Bracken, and Mason Counties don’t have a family law judge at all! This wide variation creates a great deal of variability, but usually both spouses will be liable for debt even if only one spouse took out the debt. However, Lawrence & Associates Accident and Injury Lawyers, LLC’ attorneys are skilled at finding exceptions to the general rule, so ask before you assume this will apply to you.

One thing to bear in mind is that leaving one spouse’s name off of the bankruptcy will not affect what kind of bankruptcy you can file. High income earners must file a Chapter 13 bankruptcy, because federal law will not allow anyone to file a Chapter 7 if they are making more than median income for their state. However, that median income is the income of the household, not the person filing. So, for example, assume a Northern Kentucky family makes above median income because the wife is a highly paid doctor, while the husband is disabled. Even if only the husband has debt and only the husband needs to file bankruptcy, the husband will be forced into a Chapter 13 bankruptcy because the wife’s income raises the total household income above median. Leaving the doctor off the bankruptcy will protect her credit, but will not change the husband’s bankruptcy from a 13 to a 7.

Will Filing Bankruptcy Affect My Spouse’s Credit?

In general, credit is linked to a social security number, and only the bankruptcy filer’s social security number appears on the bankruptcy filing. Each person has a separate credit file for credit reporting purposes. Your debts, if the debts are truly yours alone, are not supposed to show in your spouse’s credit report. Similarly, your bankruptcy should not show in your spouse’s file if you have no joint debts.

Will My Spouse Have to Come to Court or Be Involved?

Your spouse will certainly know a bankruptcy has been filed – the court and your attorney will mail things to your home – but your spouse should not have to attend any hearings or meetings with an attorney in the vast majority of cases.

Will Anyone Notify My Spouse’s Employer?

It is illegal for a creditor to notify your employer or your spouse’s employer, or any family members, landlords, etc. in an attempt to collect a debt. Further, the bankruptcy court only sends notices to people listed on the bankruptcy, including the debtors, the creditors, and any co-signers. As long as your husband’s or wife’s employer doesn’t fall into those categories, there is no reason the employer should find out about the bankruptcy.

One exception to this rule would occur if you choose to have your Chapter 13 bankruptcy payment (which goes to the Chapter 13 Trustee) pulled directly from your spouse’s paycheck. A paycheck garnishment is the most common way to make this payment, and the filing spouse sometimes between jobs, or has some other circumstance that makes pulling the payment from the non-filing husband or wife’s paycheck the most attractive option.

If you have any other questions about this topic, please call our Fort Mitchell, Kentucky office at 859-371-5997. We are one of the largest bankruptcy filers in Northern Kentucky and helped over 3,000 clients. We’re Working Hard for the Working Class, and we want to help you!